Beside the core business revenue, long-term equity investments have been bringing significant profits to many savvy investors such as Nasco – NAS, VCSC – VCI, and FPTS.

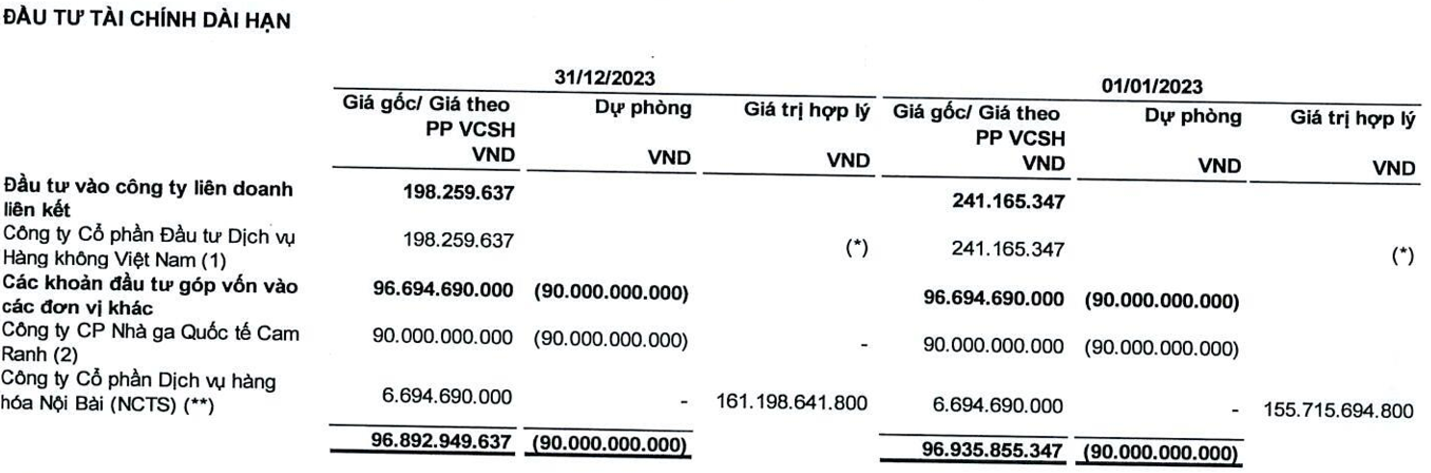

In a recent announcement, Nasco revealed the audited consolidated financial statements for 2023, showing that their investment in NCTS – NCT (a subsidiary of Nasco) has been highly profitable. Nasco has been holding shares of NCTS for over a decade. It initially purchased 669,469 shares for nearly 7 billion VND. As of December 31, 2023, the investment in NCTS by Nasco is valued at about 161 billion VND, which is 23 times its original cost.

In addition to the capital gain from the increasing stock price, Nasco has also received substantial dividends from NCTS. Since the last stock dividend distribution, Nasco has received cash dividends at a rate of approximately 700%, totaling nearly 130 billion VND, or an average of over 14 billion VND per year.

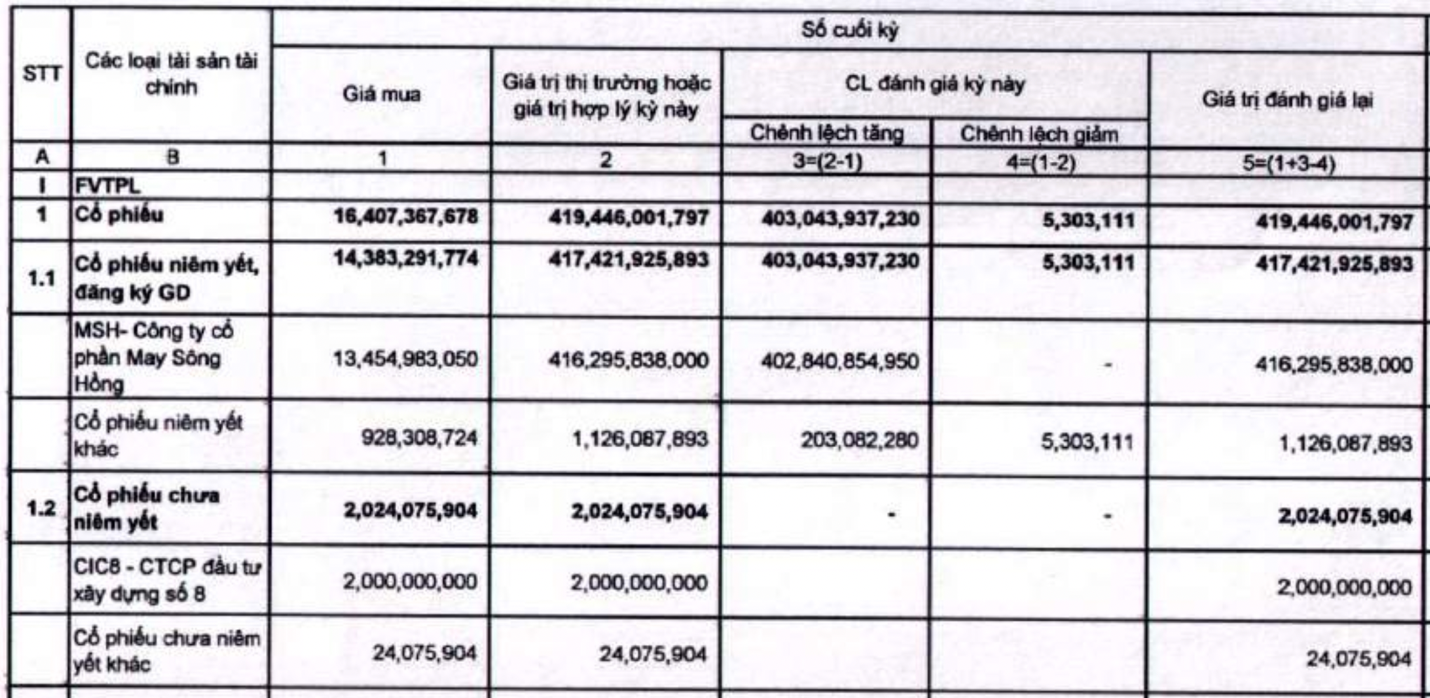

Congruously, FPTS continues to profit from its long-term investment in MSH by May Sông Hồng. In the first quarter of 2024, FPTS recorded a significant profit from the revaluation of financial investments, reaching 85.5 billion VND, a 388.5% increase compared to the same period last year. As a result, FPTS earned a profit of 167 billion VND, a 113% increase in the first quarter of this year.

Despite market volatility in recent years, FPTS has maintained a positive business performance, primarily due to the gain from holding MSH shares.

FPTS began acquiring MSH shares in 2011. According to the audited financial statements for 2021, by December 31, 2021, FPTS held 6.48 million MSH shares with a capital of over 13.6 billion VND, equivalent to an average purchase price of about 2,099 VND per share. As of March 31, 2024, the investment in MSH has a value of 416.3 billion VND, which is 31 times its original cost. Additionally, FPTS is also profiting from other stocks with a current value of over 1.1 billion VND (compared to the original price of 928 million VND).

An emblematic example of the power of long-term investment in the market is VCSC’s investment in IDP – International Dairy Products. As the latecomer who officially received 15% ownership in IDP in 2020, VCSC has made a profit of nearly 1.8 trillion VND from this stock.

Currently, VCSC owns over 8.8 million IDP shares. The investment cost was 441 billion VND, equivalent to an average purchase price of about 49,900 VND per share, while the current market price on Upcom is 245,000 VND per share.

At the 2023 Shareholders’ Meeting, when asked about the intention to sell IDP shares, Mr. Tô Hải (CEO of VCSC) stated that there is no plan to sell IDP shares as they consider IDP a strategic investment with great potential.

Mr. Hải also mentioned that in early 2023, IDP had indeed signed a contract to sell to an investor from Singapore with employees. However, the selling price of about 258,000 VND per share is not considered satisfactory, and VCSC expects a higher price.

In terms of business performance, in the first quarter of 2024, VCSC achieved a revenue of 806 billion VND, an increase of 300 billion VND compared to the same period last year. The main contribution to this quarterly revenue was the profit from selling financial assets (FVTPL), amounting to 338 billion VND, which doubled compared to the same period last year.

Also, after holding for 14 years, Vietinbank Securities (CTS) has recently “booked profits” in their investment in THACO, valuing the automotive conglomerate at 3.9 billion USD.

Before the sale, CTS owned approximately 14 million THACO shares with an investment cost of 71.9 billion VND, equivalent to the purchase price of 5,100 VND per share. This low investment cost is the result of CTS’s decision to invest in THACO since around 2009 and maintain the holding until now.

In the second quarter of 2023, CTS reportedly sold over 4.7 million unlisted shares of THACO with a total sale value of 141 billion VND, compared to the original purchase cost of over 24 billion VND, resulting in a profit of 117 billion VND. Looking at the decrease in the investment value of the unlisted stocks held by CTS, it can be inferred that the shares sold by CTS belong to Trường Hải Auto Joint Stock Company (Thaco). Thus, CTS sold 4.7 million Thaco shares at a price of 141 billion VND, equivalent to 30,000 VND per share.

Preliminarily, CTS has made a profit 6 times over 14 years of holding THACO shares, considering the price of 30,000 VND per share.